Retailer says it’s a security issue, but it also pays Visa more for signature authorization.

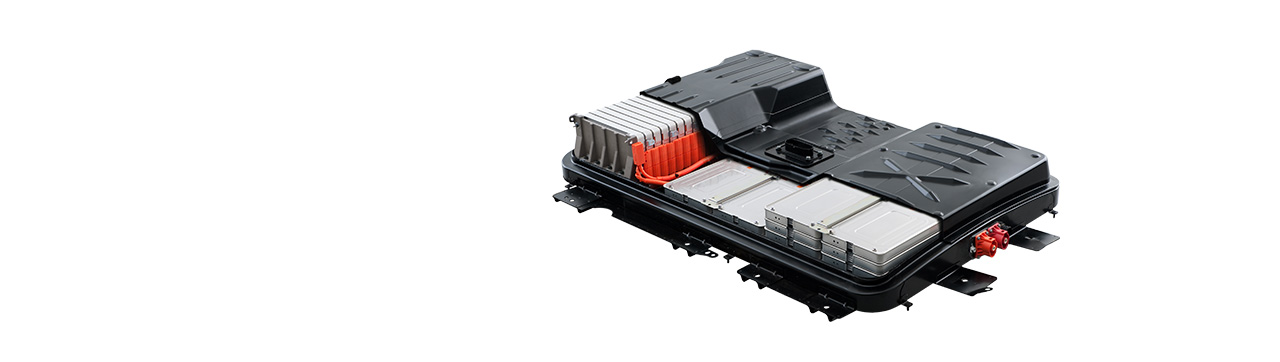

This week, Walmart sued Visa in New York State Court, saying it wanted to be able to require PIN authorizations on all EMV debit card transactions. Although many debit card transactions already require a PIN to authorize purchases or withdrawals on that card, Visa makes its merchants give Visa card holders the option to authorize with a signature. Walmart is arguing that this puts its customers at risk for fraud.

Visa, Mastercard, and other card networks set an October 2015 deadline for merchants and card issuers in the US to shift to the chip-based EMV standard (which is eponymous for Europay, Mastercard, and Visa, the three groups that developed the standard). The transition was meant to replace the magnetic stripe cards that persisted for years in the US, even after other countries quickly made the transition to the more secure chip-based cards. Walmart made the transition early last year, becoming one of the first national retailers to buy new terminals that accepted EMV cards, the Wall Street Journal reports.

But even though the EMV standard accepts PIN authorization on all cards, the major card networks said they would allow signature authorization to persist in the US and not require PIN authorization, claiming that it would minimize confusion among customers who might have trouble adapting to the new standard. Others objected to the authorization leniency, arguing that signature authorization does nothing to prevent fraud against a card holder if their card is physically stolen.

In a statement to the WSJ, Walmart said that the suit was about “protecting our customers’ bank accounts when they use their debit cards at Walmart.” Still, the paper notes that there's a monetary side to Walmart's legal salvo as well—for every signature-authorized transaction, Walmart must pay Visa five cents more than it does on a PIN-authorized transaction. According to the WSJ, about 10 percent of Visa debit-card-using customers at Walmart will ask to override the PIN authorization prompt at the checkout counter in favor of authorizing the transaction with a signature.

Mastercard, on the other hand, lets retailers choose how they will allow customers to authorize transactions.

Walmart has fought against card networks and issuers for years. One of its most recent battles involved leading a consortium of retailers to create the Merchant Customer Exchange, known as MCX, which tried and failed to launch CurrentC, a system that would authorize payments to the store directly from a customer's checking account with the help of a QR code on the customer's phone, essentially circumventing the interchange fees paid by the retailer to the credit card companies. When CurrentC failed, Walmart launched Walmart Pay in a continued attempt to wrest control from mobile payment systems like Apple Pay and Android Pay.